Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. Data published Yearly by Inland Revenue Board.

Tax And Investments In Malaysia Crowe Malaysia Plt

Rate TaxRM A.

. No tax is withheld on transfer of profits to a foreign head office. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. What is the Corporate Tax Rate in Malaysia.

Malaysia Corporate Income Tax Calculator for YA 2020 and After. This page provides - Malaysia Corporate Tax Rate - actual values historical data forecast. With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts.

These companies are taxed at a rate of 24 Annually. Corporate tax is governed under the Income Tax Act 1967 which applies to all companies registered in Malaysia for chargeable income derived from Malaysia including business profits dividends interests rents royalties premiums and other income. Malaysian resident corporations trading in Malaysia are subject to the corporation tax Malaysia 2020.

In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Corporate Income Tax Rates. Small and medium-sized businesses SMEs pay a significantly different company tax from all resident businesses.

On 11 October 2019 YB Lim Guan Eng the Minister of Finance unveiled the Malaysian Budget 2020. The revenue from the tax rate is a major source of income in Malaysia. For the purpose of the Malaysia corporate tax rate a small or medium company is one that is incorporated in the country.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. Effective from 2018 Year Assessment the following corporate taxation rate applies to all Malaysian Sdn Bhd companies. For resident companies not included in the list given below.

The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies. However in the case of a resident company the Malaysia corporate tax rate can be applied at 17 or 24 from the yearly income the lower rate of 17 is not applicable to non-resident. Corporate - Branch income.

For all non-resident status Sdn Bhd companies for eg. 3 of audited income. For resident companies with paid-up capital of up to 25 Million MYR and gross income of less than MYR 50 Million.

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company. Corporate Income is taxed in Malaysia on the following rates. This rate is relatively lower than what we have seen in the previous year.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. On the First 5000. These businesses are subject to a 24 percent tax rate Annually.

Corporate - Other taxes. Tax rates on branch profits of a company are the same as CIT rates. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021These proposals will not become law until their enactment and may be.

Corporate tax rate for resident small and medium-sized enterprises with capitalization under MYR 25 million 17 on the first MYR 600000. Mutual Agreement Procedure MAP Multilateral Instrument MLI Non-Resident. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019.

Tax rates of corporate tax as of Year of Assessment 2021. Companies with more than 50 foreign shareholders the effective tax rates would be at 24 flat. Malaysia Corporate Tax Rate History.

CIT is charged at a rate of 17 on the. Corporate companies are taxed at the rate of 24. The maximum rate was 30 and minimum was 24.

The corporate tax rate in Malaysia is collected from companies. What is Corporate Tax Rate in Malaysia. On the First 5000 Next 15000.

The amount from this is based on the total income that companies obtain while having a business activity every year. Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. This is a smaller average than what we had the previous year.

A Look at the Markets. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Advance Pricing Arrangement.

CIT is charged at a rate of 24. The benchmark used pertains to the highest Corporate Income rate. Net taxable rate for profits 24.

For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. 24 above MYR 600000.

Last reviewed - 14 December 2021. Income tax rates. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates.

Small and medium companies are subject to a 17 tax rate with the balance in this case being subject to the 24 rate. The current CIT rates are provided in the following table. Gold Analysis Twist Could Cause Inflation to Challenge 133 Not Seen Since 1979.

Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million.

7 Tips To File Malaysian Income Tax For Beginners

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Individual Income Tax In Malaysia For Expatriates

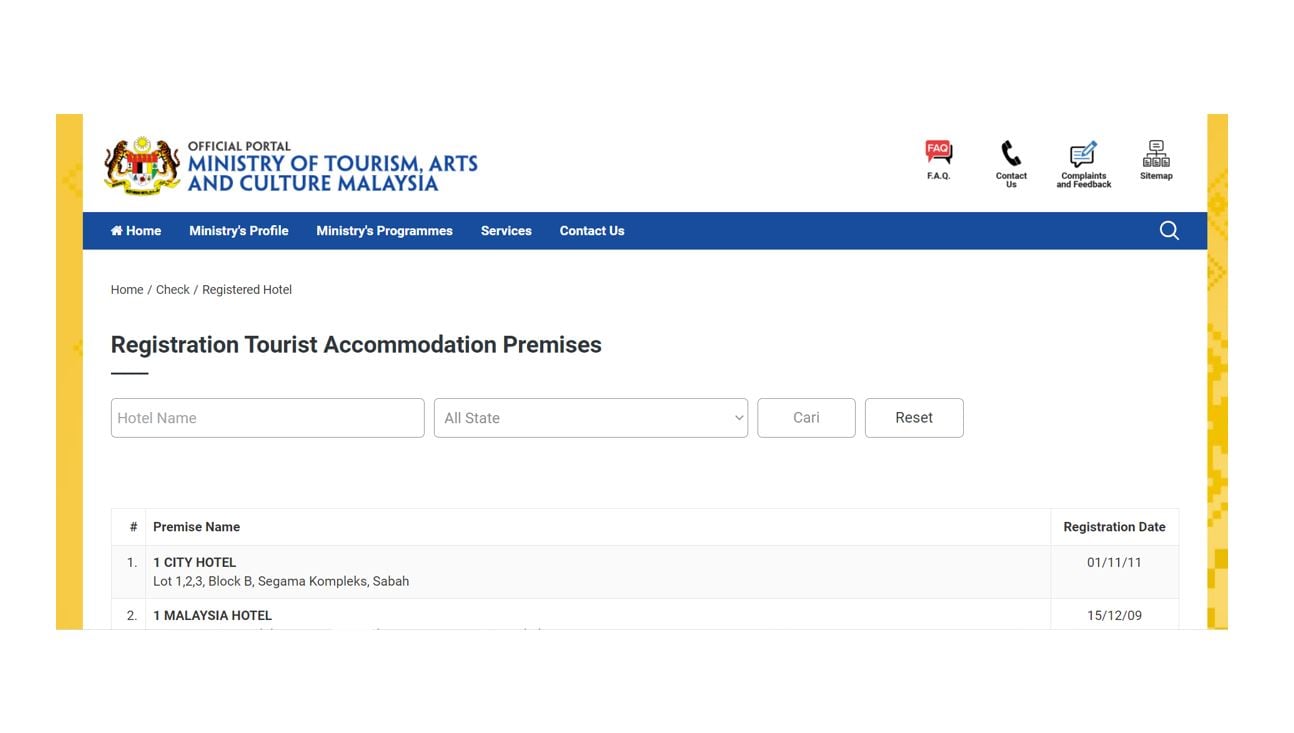

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Malaysia Personal Income Tax Guide 2022 Ya 2021

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Corporate Income Tax In Malaysia Acclime Malaysia

What Are The 3 Definitions Of Smes In Malaysia

Gst In Malaysia Will It Return After Being Abolished In 2018

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysian Bonus Tax Calculations Mypf My

Business Income Tax Malaysia Deadlines For 2021

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets